RRSP, TFSA, or FHSA: Understanding Your Best Option for a First Home

2025-05-09 | 07:24:47

Introduction

Buying your first home is an exciting milestone, but choosing the right savings strategy can be daunting. In Canada, the most popular accounts for home savings are the Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA), and First Home Savings Account (FHSA). Each has unique features, tax benefits, and usage rules. This article compares these accounts to help you choose the best option for your first home purchase.

Understanding the Accounts

Registered Retirement Savings Plan (RRSP)

The RRSP is designed for retirement savings but offers a significant benefit for first-time homebuyers through the Home Buyers’ Plan (HBP). You can withdraw up to $35,000 tax-free from your RRSP to buy your first home, but repayment within 15 years is mandatory.

Tax-Free Savings Account (TFSA)

The TFSA allows you to save and invest money tax-free. Unlike RRSPs, there are no tax deductions on contributions, but you can withdraw funds at any time without penalties, making it highly flexible for home savings.

First Home Savings Account (FHSA)

The FHSA, introduced in 2023, is specifically designed for first-time homebuyers. You can save up to $8,000 per year, with a lifetime maximum of $40,000. Contributions are tax-deductible, and withdrawals for purchasing a first home are tax-free.

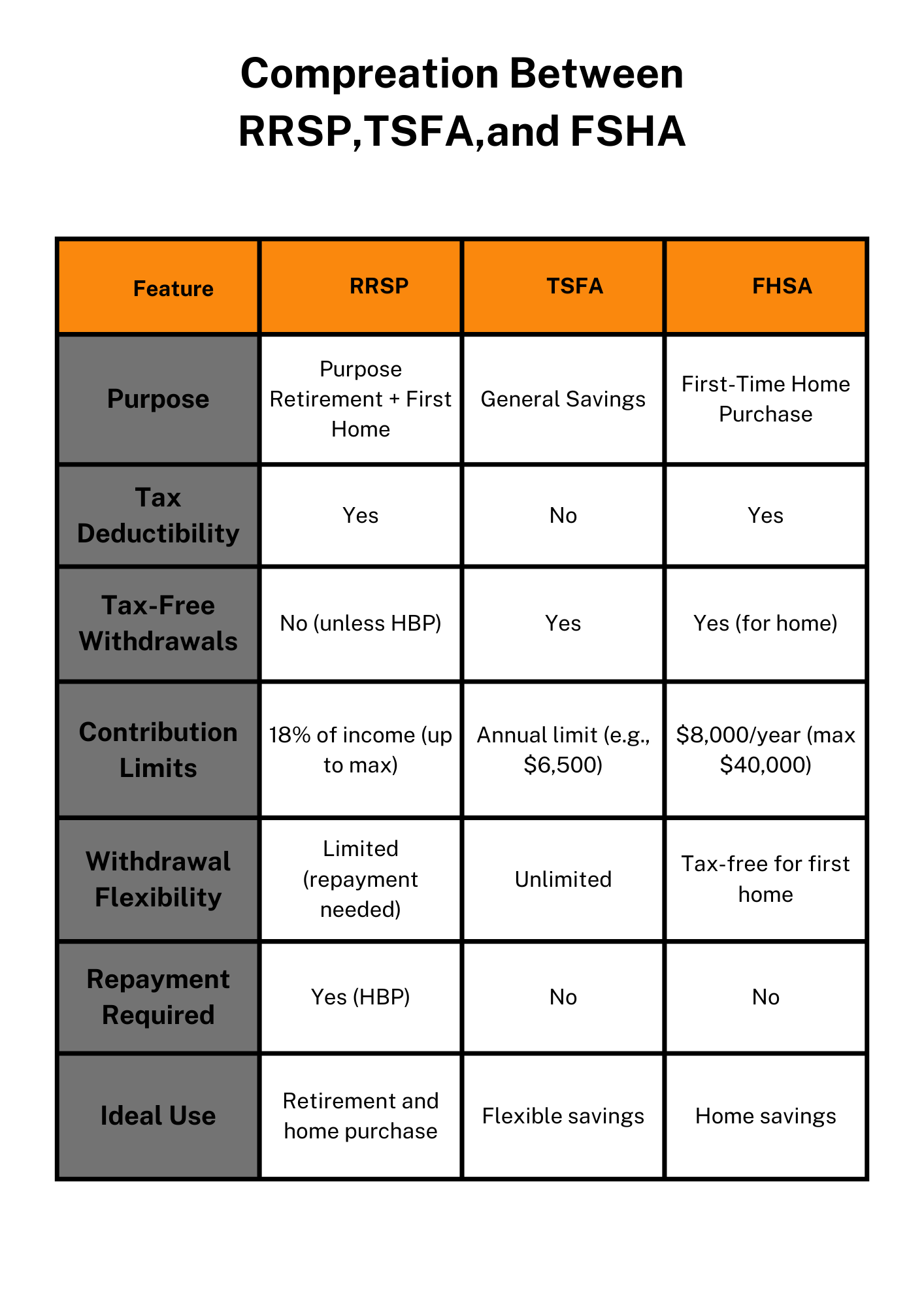

Comparison Table: RRSP vs. TFSA vs. FHSA

Pros and Cons of Each Account

-

RRSP: Great for reducing taxable income but requires repayment if used for a home.

-

TFSA: Highly flexible and tax-free withdrawals but lacks direct home purchase incentives.

-

FHSA: Tailored for first-time buyers with both tax deductions and tax-free withdrawals.

External References:

Which Account Is Best for First-Time Homebuyers?

-

Use RRSP if:

-

You want immediate tax deductions and can handle repayment within 15 years.

-

Use TFSA if:

-

You prefer flexible, penalty-free withdrawals and want to save tax-free.

-

Use FHSA if:

-

Your primary goal is saving for your first home while benefiting from both tax deductions and tax-free growth.

Combining Accounts for Optimal Savings

Using a combination of RRSP, TFSA, and FHSA can maximize your savings potential. For example, saving in an FHSA for dedicated home savings while using a TFSA for flexible cash flow can be a balanced approach.

Conclusion

Choosing between RRSP, TFSA, and FHSA depends on your financial priorities and timeline. The FHSA is often the best choice for first-time homebuyers due to its focused benefits. However, integrating multiple accounts can provide greater flexibility and tax advantages. Assess your personal financial situation and consult a financial advisor to develop a tailored savings plan.