Understanding Your Financial Options: Credit Repair and Mortgage Refinancing Demystified

2025-04-26 | 17:16:06

Understanding Your Financial Options: Credit Repair and Mortgage Refinancing Demystified

The Changing Financial Landscape in Canada

Interest Rate Trends

As of 2025, the Bank of Canada has introduced pivotal policy shifts that influence borrowing and mortgage rates. Homeowners must stay proactive and adjust their financial strategies to take full advantage of these evolving conditions.

Credit Challenges Canadians Face

With escalating consumer debt and stricter lending criteria, maintaining a healthy credit profile has become increasingly difficult. Recognizing these challenges is crucial for effective financial planning and debt management.

Credit Repair: Key Steps to Rebuild Your Credit Score

Timely Payments Matter

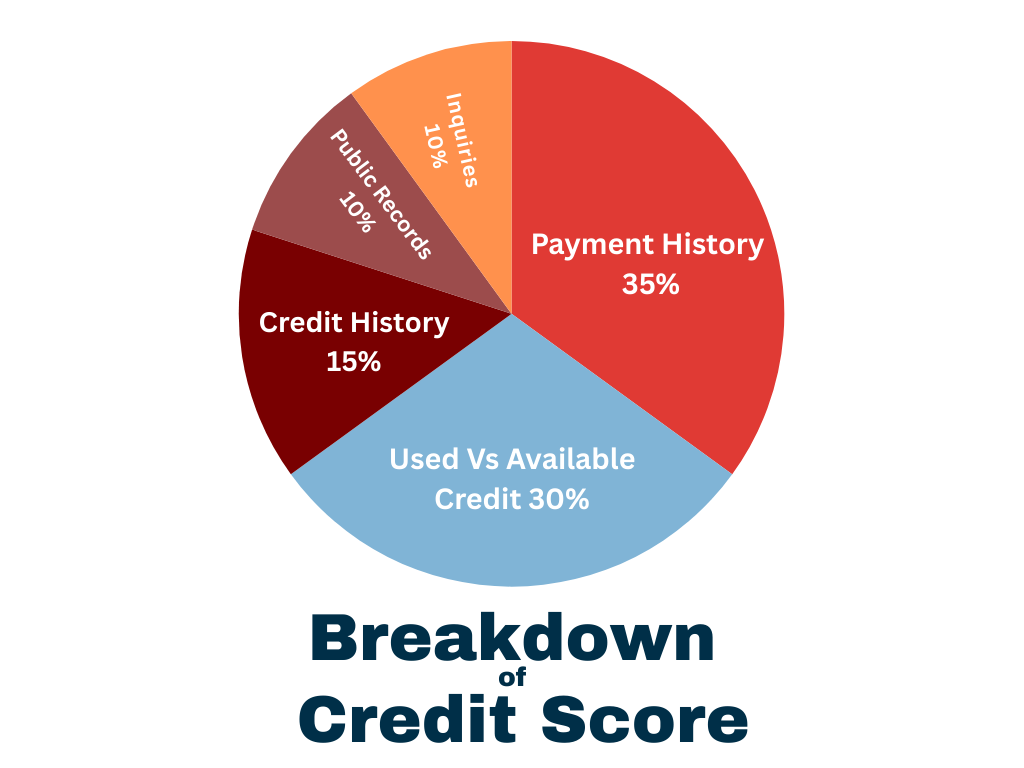

Your payment history is a major component of your credit score. Making all payments on time is essential for both maintaining and improving your credit rating.

Managing Your Credit Utilization

Aim to keep credit card balances below 30% of your available limits. High credit utilization can negatively impact your credit score, even if payments are made regularly.

Regularly Review and Correct Your Credit Reports

Access your credit reports from Equifax and TransUnion frequently. Address and dispute any inaccuracies immediately to protect your financial reputation.

Keep Long-Term Credit Accounts Active

Older credit accounts contribute positively to your credit history. Use them occasionally and pay off balances promptly to retain their benefits.

Limit Applications for New Credit

Multiple applications can lead to numerous hard inquiries, potentially lowering your credit score. Apply only when necessary and space out your credit requests.

Mortgage Refinancing: How to Leverage Your Home Equity

What Mortgage Refinancing Means

Mortgage refinancing involves replacing your existing mortgage with a new one under improved terms. It can lead to lower interest rates, reduced monthly payments, or access to home equity for other financial goals.

Basic Eligibility Requirements

Lenders typically expect a solid credit score and sufficient home equity. Meeting these standards increases your chances of securing favorable refinancing terms.

How to Refinance Your Mortgage

-

Thoroughly evaluate your current financial standing.

-

Consult an experienced mortgage professional.

-

Research and compare multiple refinancing options to choose the best plan.

Potential Risks and Costs

Refinancing often includes costs such as appraisal fees, legal charges, and early repayment penalties. Assess whether these expenses are justified by the long-term savings and benefits.

Merging Credit Repair with Mortgage Refinancing

Developing a Strategic Financial Plan

Improving your credit score can unlock better refinancing rates. In turn, successful refinancing can streamline your debt management efforts, fostering long-term financial health.

Seeking Expert Guidance

Collaborating with mortgage specialists and credit counselors ensures that your financial strategies are tailored to your unique situation and goals.

Conclusion: Take Charge of Your Financial Future

Successfully navigating credit repair and mortgage refinancing requires careful planning, informed decisions, and professional support. By understanding your options and taking deliberate action, you can build a stronger financial foundation and secure a more prosperous future.

Frequently Asked Questions (FAQs)

How long does it take to improve a credit score?

Consistent positive credit behavior can lead to noticeable improvements within three to six months, depending on your starting point.

Can I refinance my mortgage with a low credit score?

Absolutely! While refinancing with a low credit score can be more challenging, it is far from impossible. Many lenders offer specialized programs designed to assist individuals with less-than-perfect credit. By working with a knowledgeable mortgage professional, exploring flexible refinancing options, and demonstrating strong financial habits, you can unlock opportunities that pave the way toward better financial health and even more favorable terms in the future.

What are the typical costs associated with mortgage refinancing?

Costs may include appraisal fees, legal fees, and early repayment penalties. It’s important to weigh these expenses against the potential financial benefits.

How does refinancing impact my credit score?

Refinancing can cause a temporary dip in your credit score due to a hard inquiry, but maintaining good financial habits afterward typically leads to recovery and even improvement over time.